As a Chief Investment Office, we offer our clients independent expertise and advice, with access to investment opportunities not typically available to private investors.

We have deep experience working with successful Canadian families, entrepreneurs, and the foundations they support. We have also done extensive due diligence and developed strong relationships with a global network of top-tier investment managers from which to construct portfolios.

Our goal is to provide a superior, long-term, risk-adjusted return for our clients based on their wealth goals.

Our unique investment approach is based on four solid principles:

1. Asset allocation

The majority of portfolio risk is most often captured by asset allocation. Investment characteristics such as geography, size, and style are the determinants for long-term investing success. We construct global portfolios designed to align with client risk tolerance and diversify away market unknowns. Our depth of experience and expertise, combined with our proprietary analysis, allows our research to design the portfolio exposures that captures the benefits and tailwinds of proper diversification.

2. Analysis & technology-driven research for manager selection and monitoring

We employ proprietary, data driven research to the manager selection process. We assess if we can replicate the returns of any given manager using low-cost exchange traded funds. If we are able to replicate their returns, there is no “alpha” or excess return offered by the manager and thus no value add relative to a low-cost solution. It is the unexplainable component of the return, the part that we are unable to replicate, that we are seeking when hiring an active manager. We then continuously assess those managers to evaluate their ability to consistently and persistently provide return in excess of their respective benchmark.

3. Actively managed portfolio construction & optimization

Our approach to building your investment plan considers your tolerance for risk, your long-term wealth objectives, and your entire wealth portfolio. We utilize our research and technology to curate a portfolio strategy unique to your goals and continually evaluate and hold managers accountable for specific portfolio exposures and performance.

4. Alternatives as a differentiator

Investment strategies that elongate one’s time horizon or those that capture return streams not easily replicable by traditional means can offer distinct advantages to a resilient portfolio by enhancing returns and diversifying risk.

Building resilient portfolios is foundational to our investment approach

We know with certainty that every investment incurs some level of risk, but our focus is on taking measured levels of risk to realize a sufficient level of return to meet our families’ and foundations’ long-term objectives. Our strategy focuses on protecting from loss while participating in growth opportunity. From the inception of our strategy, we have provided above-market returns with lower volatility.

The building blocks of the Grayhawk investment platform:

Strong foundation

Active management of low-cost global equity and fixed income investments with thought-leading approaches to portfolio construction and risk allocation.

Growth potential

Active public market equity managers sourced from around the globe with proven ability to add value after fees.

Income generation

Globally-sourced, active fixed income managers allow us to generate regular income using various credit, yield and duration exposures.

Alternative returns

Sources of return that do not duplicate traditional public markets provide access to opportunities typically closed to many families.

Portfolio construction

1. Strategic allocation

- Our investment process begins with a conversation. We listen carefully to understand the unique situation of each family or foundation.

- We develop a long-term personalized plan that aims to ensure stability through changing market conditions.

- We focus on diversification to reduce risks and improve investment outcomes.

2. Tactical allocation

- We constantly seek to leverage market trends or economic conditions by actively adjusting the allocation of a portfolio between different asset classes or within them.

- This active management approach aims to systematically exploit perceived inefficiencies or temporary imbalances between different asset or sub-asset classes.

3. Portfolio implementation

- The personalized plan for each family or foundation is implemented using a combination of active and passive solutions.

- We select investments based on their individual merits, but also their role in the context of a broader portfolio.

- Portfolio implementation aims to capture the spirit of customized objectives while providing advantageous active management.

Multi-asset portfolios

Incorporating investment solutions that can enhance returns and further diversify risk.

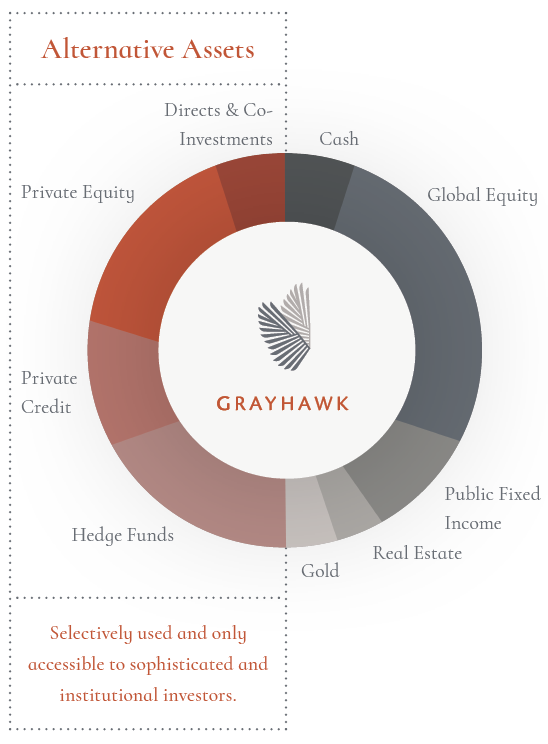

Grayhawk’s traditional and alternative asset solutions include access to private equity, hedge funds, private credit, public equity, and fixed income opportunities.

These solutions provide clients with exclusive access to global opportunities not available to typical investors, while improving portfolio diversification and reducing correlation to the variability of the stock market.

A diversified portfolio strategy.